Volume Profile (Composite) allows you to build a summary Volume Profile of the last x sessions, days, weeks, months, years or starting from a specific date/time up to the last available bar

Click HERE for a general overview of the various types of Volume Profiles available and useful tips

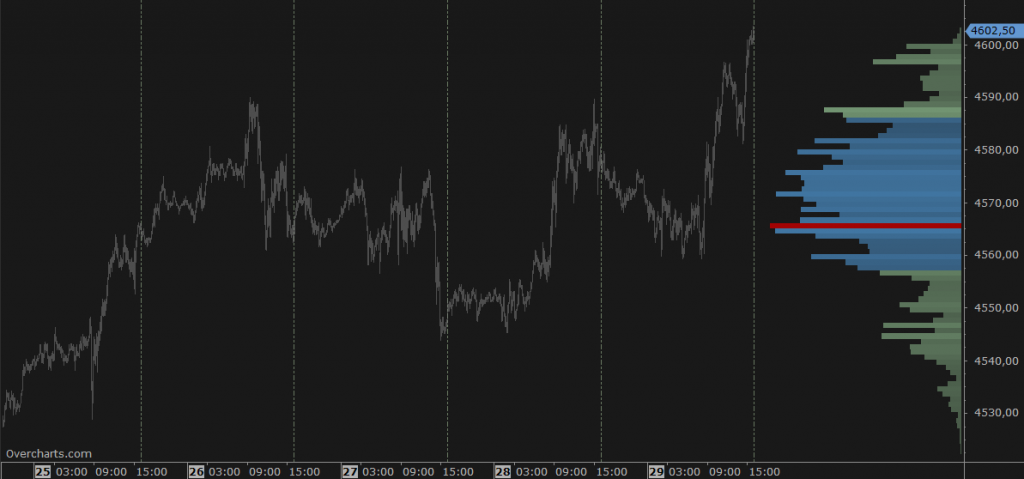

It is drawn on the right or left side of the chart:

Composite Volume Profile also allows you to automatically draw horizontal lines corresponding to the volume profile peaks and valleys. These are potential support/resistance levels at significant peaks/valleys:

Calculation Properties #

You can access calculation properties from Properties Tab of the indicator configuration window.

Calculate using: specifies whether to use Volume or Tick Count (number of trades) to calculate the indicator. Unless you have special needs, we recommend you use the Volume.

Time Range: specifies the number of sessions, days, weeks, months, years, bars on which to calculate the indicator. Alternatively, you can specify a start date.

If you are using 1-Tick resolution data to build the indicator, we recommend you not to overdo the time range. Data loading and calculation times progressively increase as the time interval increases. However, there is no recommended maximum time interval. It depends on many factors and in particular on your PC performance, your Internet line and your data feed. Set this property correctly according to your needs and the performance of your PC/data-feed. If you notice very long loading times, decrease the time range.

Value Area (%): specifies the Value Area width (as a percentage). Typical value of this property is 68.2 (default). We recommend you do not change it unless you have special needs.

Ticks per Row: specifies the width (in ticks) of each single price level. A tick is the smallest price movement (tick-size) defined in the instrument configuration. Usually, the correct value for this property is 1. For some instruments, where the tick-size is very small compared to the current price (eg US stocks), it may be necessary to group a number of price levels into a single level by setting this property to a value greater than 1.

Resolution: defines the resolution of data to be used to calculate the indicator:

- Same as chart: 1-Tick, 1-Minute or 1-Day resolution is used depending on chart resolution

- 1-Tick: use this resolution to get the best possible volume profile (highest definition). It is NOT not recommended if time interval where the volume profile is calculated is greater than a few days, due to the huge amount of data needed for the calculation. Data loading and calculation times can be long.

When the resolution is 1-Tick, by setting Bid/Ask – Calculation Method property you can choose with which calculation method the volume of every single tick is assigned to Bid or Ask:- Tick Direction: volume is assigned to Bid or Ask based on direction of current tick compared to previous one. In other words, if current tick price is higher than previous one the volume is assigned to Ask, if lower it is assigned to Bid, if equal it is assigned to bid or ask based on the last assignment made.

- Bid/Ask: volume is assigned to Bid if seller is the aggressor, or to Ask if buyer is the aggressor. If the aggressor is unknown and price is between bid and ask, the volume is assigned to bid or to ask depending on last assignment made.

- 1-Minute: use this resolution to get an approximate volume profile (recommended if time interval where the volume profile is calculated is greater than a few days). Data loading and calculation times are very short

- 1-Day: use this resolution to get an even more approximate volume profile and only if the defined time range is many years. Data loading and calculation times are very short

If data resolution is other than 1-Tick, total bar volume is assigned to price level corresponding to the bar close.

Session: Specifies daily session where to calculate the indicator. Session is a data filter (out-of-session data is not considered in the calculation). Chart session is used by default. However you can define a different session to filter the data. Useful, for example, if chart is built on ETH-session and instead you want to calculate the volume profile using only RTH-session data.

Peaks/Valleys – Sensitivity: represents the sensitivity to use to find peaks and valleys. The higher the sensitivity, the greater the number of peaks and valleys found. Peaks and Valleys are horizontal lines drawn automatically corresponding to the volume profile peaks and valleys. These are potential support/resistance levels at significant peaks/valleys.

In addition to the properties listed here, there are many other properties that are minor or do not need further explanation.

Style Properties #

You can access style properties from Style Tab of the indicator configuration window.

WARNING: In addition to the properties listed here, there are many other properties that are minor or do not need further explanation.

Volume Profile #

Direction: specifies volume-bars direction: from Right to Left or Left to Right.

Position: specifies whether to draw the volume profile on the right or left side of chart.

Width: specifies the volume-profile width as a percentage or pixels. If percentage, volume-profile width will be a percentage of the chart area.

Display as: specifies how volume profile is displayed:

- Volume: volume bar is colored with a single color. Color changes according to the zone to which the bar belongs (internal or external to the Value Area) and will be more or less intense depending on bar volume and the opacity (min/max) specified.

You can choose between a classic or smoothing style and whether or not to draw only the border (useful for making the volume profile less flashy). - Bid/Ask: volume bar is divided into 2 parts of different colors corresponding to the volume generated on BID and the volume generated on ASK. This displaying type requires the use of 1-Tick resolution data to build the indicator.

- VPOC Only: only VPOC bar is displayed.

Delta Profile #

Delta Profile is often used to complement the volume profile and shows the delta of each price level. In other words, the difference between volumes generated on ASK minus volumes generated on BID.

You can choose whether to draw Delta Profile together with Volume Profile, as an alternative to Volume Profile, or not to draw it. However, to draw Delta Profile you need to use 1-Tick resolution data to build the indicator

In case volume profile is drawn together with delta profile, some style and position properties are inherited from volume profile

Direction: specifies bars direction: from Right to Left or Left to Right.

Position: specifies whether to draw Delta Profile on the right, left or overlapped on volume profile. In case Volume Profile is NOT visible, it specifies the position of delta profile with respect to the chart.

Width: specifies the width of delta profile as a percentage of total space reserved for volume profile + delta profile. For example, if total space of volume profile + delta profile is 100 pixels and the width of delta profile is 30%, then volume profile and delta profile will be 70 and 30 pixels wide respectively (total space reserved for volume profile + delta profile is defined in volume profile Width property).

If volume profile is NOT visible, you can set delta-profile width in percentage or pixels. If percentage, delta profile width will be a percentage of the chart area.

VPOC (Volume Point of Control) #

VPOC is the price level with the greatest volume, around which the value area is calculated. Use properties available in this section to draw or not the VPOC and set it according to your needs.

VPOC Trace Line #

Trace-Line is a broken line showing the VPOC position over time within the period where the volume profile is calculated. Use properties available in this section to draw or not the Trace-Line and set it according to your needs.

Peaks/Valleys #

Peaks and Valleys are horizontal lines drawn automatically corresponding to the volume profile peaks and valleys. These are potential support/resistance levels at significant peaks/valleys. Use properties in this section to draw peaks and valleys levels or not and set them according to your needs.

Summary #

You can display at the volume profile bottom some summary values such as Total Volume, Total Delta, High/Low Range and time interval where the volume profile is calculated. Set according to your needs which summary values to show using the properties available in this section.