The Fair Value Gap is a very popular indicator among price action traders. This indicator highlights imbalances, inefficiencies or liquidity voids in the market that occur when buying/selling forces exert significant pressure, leading to substantial and rapid price movements. These movements, whether bullish or bearish, create gaps in the market that are not sustainable in the long term. The market will tend to self-correct and return towards these areas before continuing in the same direction as the initial impulsive movement.

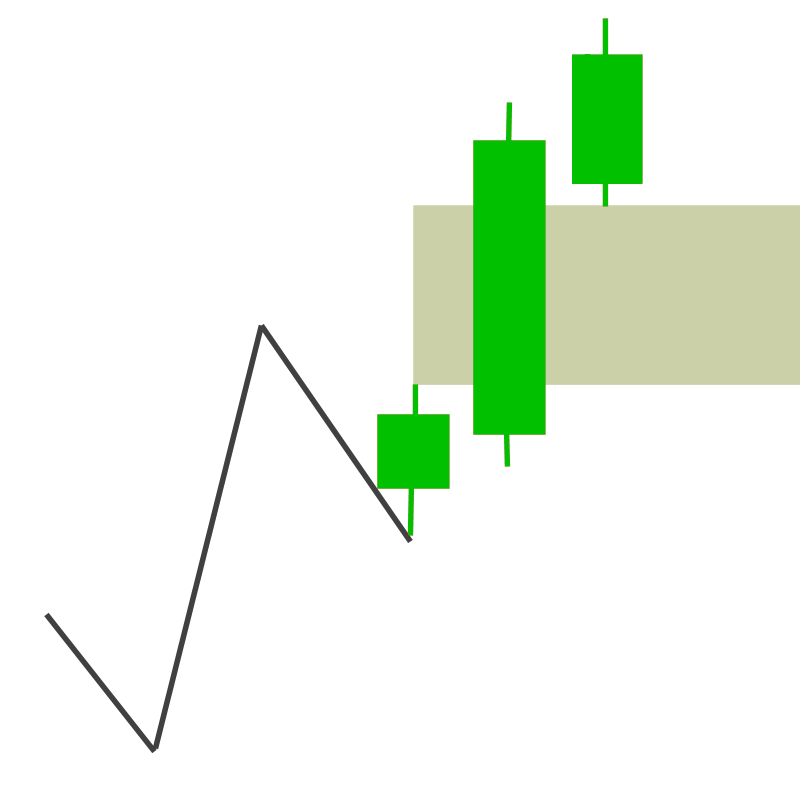

Support Gap #

A support gap must respect the following rules:

- Be composed of 3 bars.

- The middle bar length must be greater than the average length of last x bars.

- Real body length (Open – Close) of middle bar must be a wide part of the bar.

- Middle bar Close must be greater than left bar High.

- There must be a positive difference of at least x ticks between left bar High and right bar Low. This width actually represents the Gap. The greater the width, the greater the gap importance.

- Left and right bars can only partially overlap the middle bar. The smaller the overlap, the greater the gap importance.

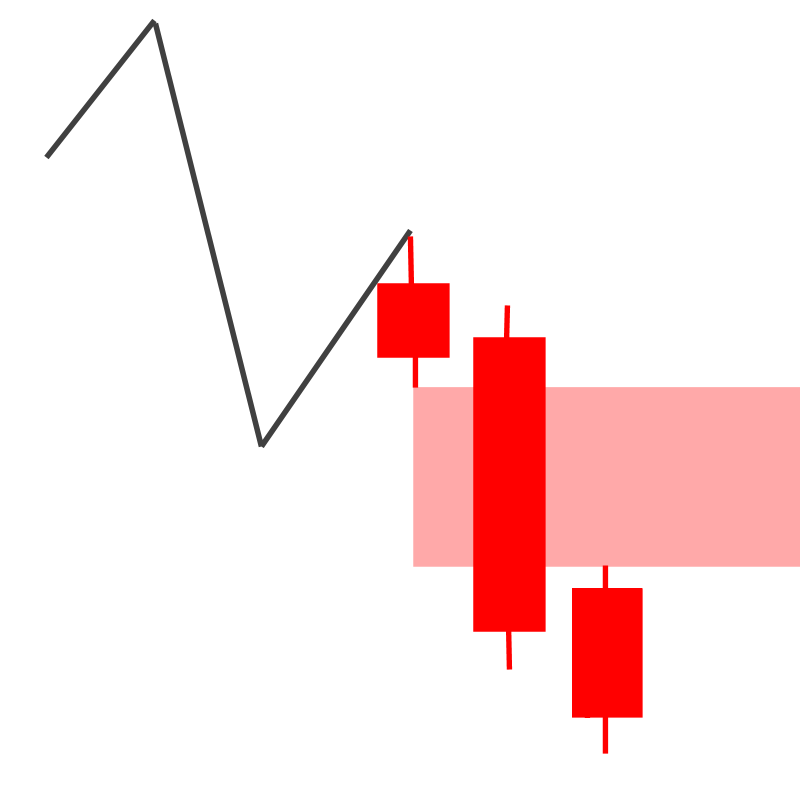

Resistance Gap #

A resistance gap must respect the following rules:

- Be composed of 3 bars.

- The middle bar length must be greater than the average length of last x bars.

- Real body length (Open – Close) of middle bar must be a wide part of the bar.

- Middle bar Close must be lower than left bar Low.

- There must be a positive difference of at least x ticks between left bar Low and right bar High. This width actually represents the Gap. The greater the width, the greater the gap importance.

- Left and right bars can only partially overlap the middle bar. The smaller the overlap, the greater the gap importance.

Calculation Properties #

Time Range: Specify the number of sessions / days / weeks / months / years on which to calculate the indicator.

Gap Minimum Size (ticks): Defines the minimum gap size in ticks. 1 tick is equal to the minimum price movement of instrument.

Middle-Bar Real-Body Min Size (%): Defines (in percentage) the middle-bar real-body (Close-Open) minimum size compared to its total size (High-Low). The greater the real body size, the more ideal the gap.

Middle-Bar Max Overlap (%): Specifies (in percentage) how much the left and right bars can overlap the middle bar. The smaller the overlap, the more ideal the gap.

Ticks beyond gap: Gap is filled if the price exceeds it by x ticks or more.