A Simulation Account defines all trading account settings (commissions, annual interest, initial capital, required margins, etc.) and is used in SIMULATOR Workspaces, in Trading-System testing, and in general in all situations where trading is LOCALLY SIMULATED by Overcharts.

Access Account list #

You can access the Simulation Account list in one of the following ways:

1. Overcharts main window > Instruments Tab > Simulation Account button

2. Overcharts main window > Instruments menu > Simulation Account

Create or Edit an Account #

To create/edit a Simulation Account:

1. Access the Simulation Account list

2. Select the account to modify and press Edit button, or press New button to create a new account.

Overcharts already contains some preconfigured accounts. You can edit the properties of a preconfigured account as you wish. To restore the default configuration of a preconfigured account, select the account in the list and press Restore Standard button.

General Properties #

Account

- Account Name: defines the account name

Costs & Capitalization

- Currency: specifies the account base currency

- Initial Equity: initial capital available in the account.

- Annual Interest Rate: defines (as a percentage) the account annual interest rate. If specified, interest will be calculated on capital not used in trades/positions.

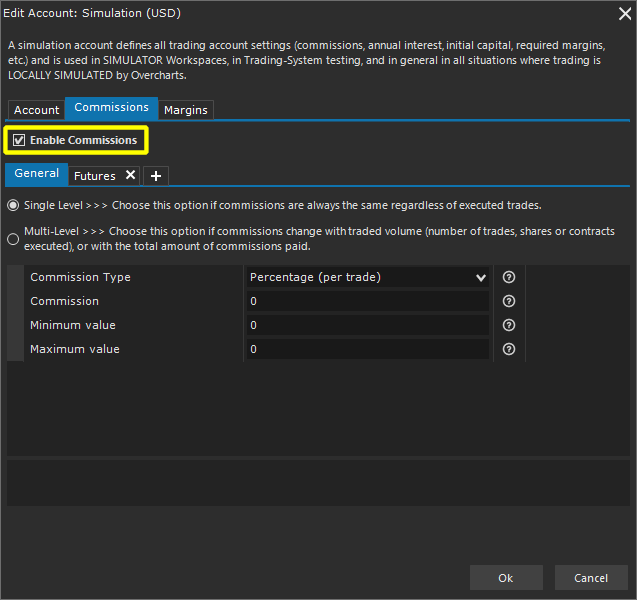

Commissions #

To specify commissions (cost of trades) to be used in the account, access Commissions Tab, then select Enable Commissions check-box:

In General section, you can define default commissions, valid for all instruments.

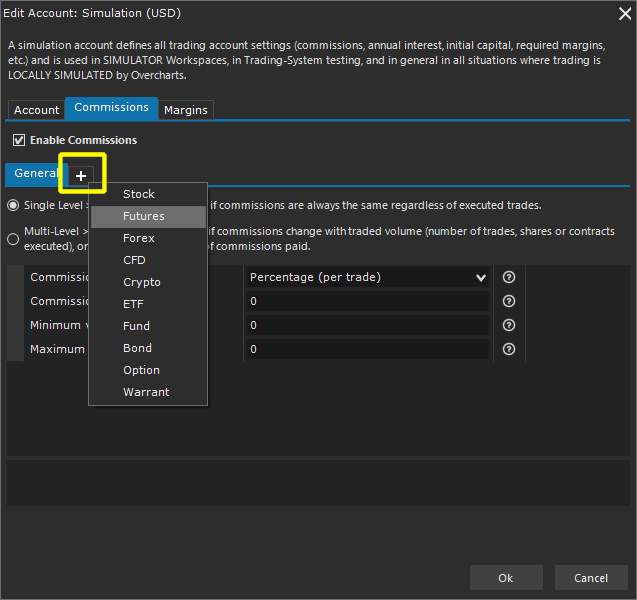

To specify different commissions based on instrument type (shares, futures, etc.), add the relevant section by clicking on + button in the Tab, and selecting the instrument type:

In the instrument configuration, you can define specific commissions for the instrument which will be used instead of the commissions defined in the account. In other words, commissions defined in the instrument configuration will always override commissions defined in the account.

Commission Levels #

- Single Level: by selecting this option, commission level is the same regardless of volume traded.

- Multi-Level: By selecting this option, you can define different commission levels based on volume traded (number of trades, shares/contracts executed) or total commissions paid in a given period of time (usually a month).

Single-Level #

- Commission Type:

- Percentage (per trade): commission is calculated as a percentage of trade total value.

- Cash (per trade): commission is fixed (in cash) for each trade.

- Fixed (per share/contract): commission is fixed (in cash) for each share/contract.

- Commission: commission amount (in cash if Commission-Type is Fixed/Cash, in percentage if Commission-Type is Percentage).

- Minimum Value: (in cash) represents minimum fee applicable to a single trade (0 = disabled).

- Maximum Value: (in cash) represents maximum fee applicable to a single trade (0 = disabled).

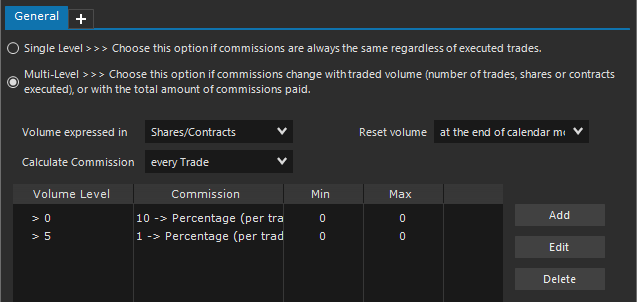

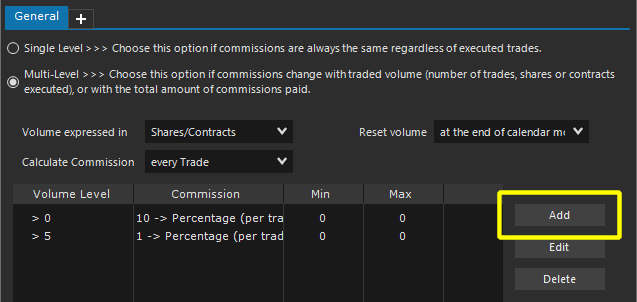

Multi-Level #

In a multi-level commission system, the commission level to be applied to a trade depends on the amount of total volume traded in a given period of time:

- In the Volume expressed in combo-box, select how total traded volume is expressed:

- Shares/Contracts: total volume is the sum of all shares/contracts traded.

- Number of filled Trades: total volume equals the number of trades executed.

- Commissions paid: total volume is the sum of commissions paid (cash).

- In the Reset Volume combo-box, select how to reset the traded volume count:

- Every Trade: volume is reset to zero with each trade. Use this method if the commission level is calculated only based on volume generated in the single trade.

- At the end of calendar month: volume is reset to zero at the end of each month.

- In the Calculate Commission combo-box, select when to calculate the commission level to use:

- Every Share/Contract: the commission level to be used is calculated for each new share/contract traded based on total volume traded up to that moment.

- Every Trade: the commission level to be used is calculated with each order executed.

- Every Day: the commission level to be used is calculated each day based on total volume achieved the previous day.

WARNING:

- If Calculate Commission is set to Every Day, Reset Volume must be set to At the end of calendar month.

- If Volume expressed in is set to Number of filled Trades, Calculate Commission cannot be set to Every Share/Contract.

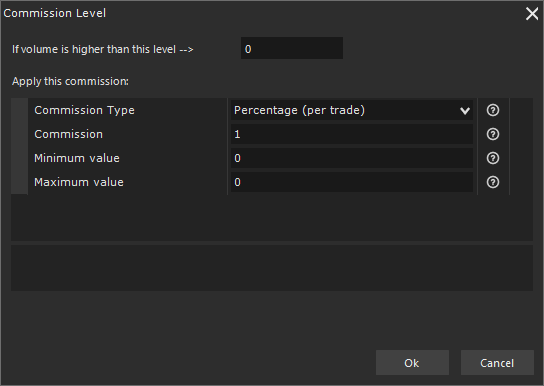

Add commission levels by pressing Add button:

You can add up to 10 commission levels

For each level, define the volume amount you need to reach to apply the commission. In other words, the commission level is applied if total traded volume is greater than the defined volume amount.

You MUST set volume level to zero in the first commission level added.

Once the volume is defined, set the following properties:

- Commission Type:

- Percentage (per trade): commission is calculated as a percentage of trade total value.

- Cash (per trade): commission is fixed (in cash) for each trade.

- Fixed (per share/contract): commission is fixed (in cash) for each share/contract.

- Commission: commission amount (in cash if Commission-Type is Fixed/Cash, in percentage if Commission-Type is Percentage).

- Minimum Value: (in cash) represents minimum fee applicable to a single trade (0 = disabled).

- Maximum Value: (in cash) represents maximum fee applicable to a single trade (0 = disabled).

To edit/delete a level, select the level in the list and press Edit/Delete button depending on the action to be performed.

Margins #

On some instruments (such as Futures) it is not necessary to have the entire trade value in the account, but a guarantee margin is sufficient. The value of this margin is defined by the exchange/broker and can also be different for each instrument.

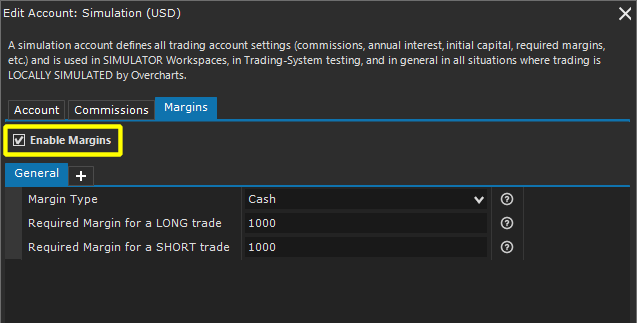

To specify margins required in trading operations, access Margins Tab, then select Enable Margins check-box:

In General section, you can define default margins, valid for all instruments.

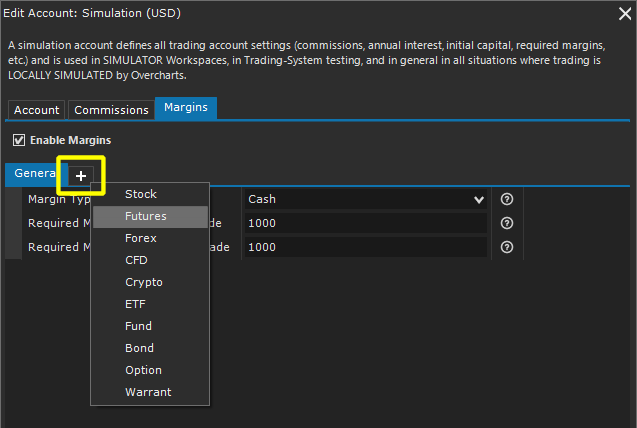

To specify different margins based on instrument type (shares, futures, etc.), add the relevant section by clicking on + button in the Tab, and selecting the instrument type:

In the instrument configuration, you can define specific margins for the instrument which will be used instead of the margins defined in the account. In other words, margins defined in the instrument configuration will always override margins defined in the account.

Properties:

- Margin Type: specifies whether the margin is defined in Cash or Percentage.

- Required Margin for a LONG trade: specifies the margin required for each LONG trade. Margin is expressed in Cash or Percentage depending on Margin-Type. If set to 0 (ZERO), the required margin will be equal to trade total value.

- Required Margin for a SHORT trade: specifies the margin required for each SHORT trade. Margin is expressed in Cash or Percentage depending on Margin-Type. If set to 0 (ZERO), the required margin will be equal to trade total value.

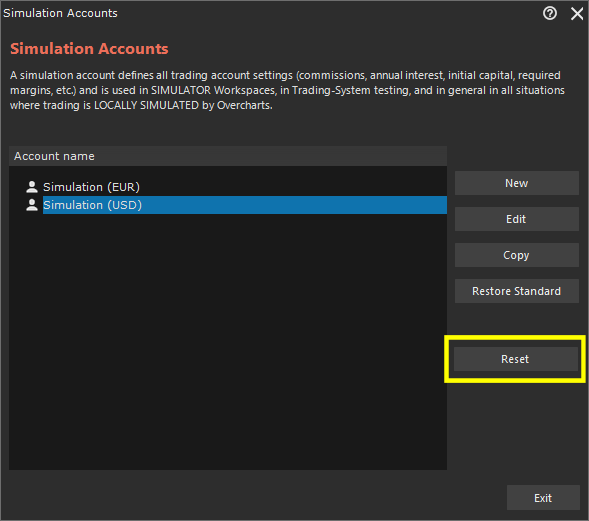

Reset a Simulation Account #

You can reset a simulation account at any time. The reset deletes all orders and positions from the account and restores the balance to an initial state.

To reset a simulation account:

- Access the simulation account list

- Choose the account to reset

- Press Reset button

- Select the connections where to reset the account. Please note that each connection has its own account situation (orders, positions, balance). The account will be reset ONLY in the selected connections.

- Press OK to reset.