To use an instrument in Overcharts you need to add it to the instrument list and configure it. Configuration is an instrument mapping that groups all instrument settings in one place: name, symbol, exchange, currency, tick-size, data connection, trading connection etc.

Add / Configure an Instrument #

For some connections there are many preconfigured instruments. If you do not find the instrument you are interested in among the preconfigured instruments, you can add it MANUALLY or using the DICTIONARY (RECOMMENDED).

Manual configuration is ABSOLUTELY NOT RECOMMENDED, unless there are special needs.

Using manual configuration you will have to set each property by yourself, while using the dictionary all (or almost) properties will be set automatically

To add and configure an instrument MANUALLY:

1. Press the arrow on the right side of Add Instrument button found in the Overcharts main window > Instruments Tab

2. Select Manually menu

3. In the configuration window, set all properties one by one (see property descriptions below)

To add an instrument using the DICTIONARY (RECOMMENDED):

1. Connect to data-feed from Overcharts main window > Connections Tab

2. Press Add Instrument button from Overcharts main window > Instruments Tab

3. Select the connection and press OK to open Dictionary window

4. Find instrument/s in the Dictionary window

5. Select one or more instruments and press OK

6. Select the exchange where instrument is listed. For example, for ES futures (S&P 500) reference exchange is CME Globex. If you do not find the right exchange for the instrument in exchange list, please create a new exchange.

The exchange is a FUNDAMENTAL attribute of the instrument. Defining it incorrectly or defining properties such as session or time-zone incorrectly results in the incorrect display of charts, DOM and anything else concerning the instrument.

7. Once the exchange is selected, a grid is displayed containing the instruments chosen previously. All (or almost all) grid fields are set automatically. Most of the time you will NOT need to change anything and just move on to the next step.

Other times, however, depending on data-feed, some fields may be NOT set. If a field has not been set automatically, it means the data-feed does not provide this information. In this case you will need to set it manually.

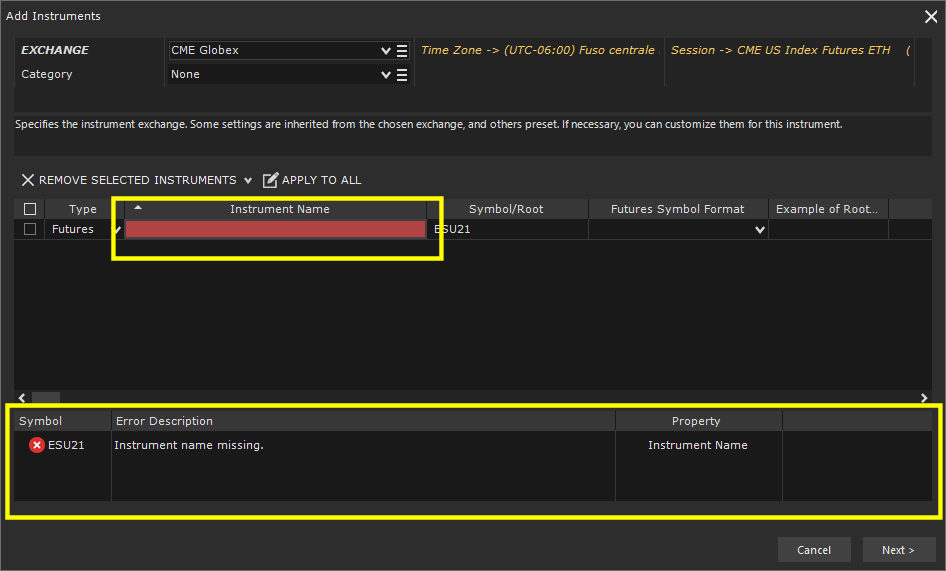

If some grid cells are highlighted in red, it means value contained in the cell is incorrect or absent. The relative error message is shown in the grid below or by hovering over the cell in error.

In the case of a futures, you can enable the Rollover Management directly in this step by choosing the right Futures Symbol Format and Expiration Rule. To find out more, I recommend you read the following documentation: Futures Symbol Format, Expiration rule and Rollover

Available fields and their meaning:

Type: specifies instrument type: Stock, Futures, Index, CFD etc. This is a FUNDAMENTAL attribute and must be set correctly!

Instrument Name: defines instrument name. You can choose instrument name according to your needs. The name MUST be unique at connection level

Symbol/Root: represents instrument symbol or root (in case of Futures with Rollover Management enabled)

Futures Symbol Format: (optional) must be set to enable rollover management of a futures instrument

Expiration Rule: (optional) must be set, together with Futures Symbol Format, to enable rollover management of a futures instrument

Trading Session: defines instrument trading days and hours. Unless there are special needs, it is always set to Same as Exchange

Tick-Size: minimum price movement. Each instrument has its own tick-size

Price Format: Decimal, 1/4, 1/8, 1/16, 1/32 etc.

Point Value: cash value of 1 point. Each instrument has its own Point Value. It is used for futures (for shares or other type of instrument the value is always 1)

Currency: instrument currency

8. Press Next to add instrument/s.

View / Edit Configuration #

You can access instrument configuration in one of the following ways:

1. From Overcharts main window > Instruments Tab > select instrument in the list > Edit button

2. From Overcharts main window > Instruments Tab > select instrument in the list > right click > Edit Instrument

3. From Overcharts main window > Instruments Tab > Double click on instument in the list

All instrument properties are grouped in the instrument configuration window. From this window you can change almost all available properties.

Properties are divided into 3 Tabs:

Instrument General Properties #

Main Connection: specifies main connection to which the instrument belongs.

To enable instrument for trading, main connection MUST provide a trading service. If main connection is a data only connection then you will NOT be able to trade the instrument

Type: specifies instrument type: Stock, Futures, Index, CFD etc. This is a FUNDAMENTAL attribute and must be set correctly!

Exchange: exchange where instrument is listed. For example, for ES futures (S&P 500) reference exchange is CME Globex. If you do not find the right exchange for the instrument in exchange list, please create a new exchange.

Instrument Name: defines instrument name. You can choose instrument name according to your needs. The name MUST be unique at main connection level

Manage Rollover: (visible only if instrument is a futures) if selected, it enables the rollover management making the futures continuous

Symbol: represents instrument symbol. It MUST be the same as that used by main connection to identify the instrument

Root: (visible only if instrument is a futures and Rollover Management is enabled) it is displayed as an alternative to the symbol and represents the constant part of futures symbol, that is, the part that DOES NOT change when futures-expiry-date changes

Futures Symbol Format: (visible only if instrument is a futures and Rollover Management is enabled) together with Expiration Rule it is used by rollover management to build instrument symbol

Expiration Rule: (visible only if instrument is a futures and Rollover Management is enabled) together with Futures Symbol Format it is used by rollover management to build instrument symbol

Time zone: (NOT editable) is inherited from exchange and represents time-zone where the exchange is based. For example, CME time zone is U.S. Central Time (Chicago time-zone). Nasdaq or NYSE time-zone is Eastern Standard Time (New York time-zone) etc.

Session: defines instrument trading days and hours. Unless there are special needs, it is always set to Same as Exchange

Tick-Size: minimum price movement. Each instrument has its own tick-size

Tick-size is a instrument FUNDAMENTAL parameter. It is used everywhere in the application (on charts, indicators, DOMs, Trading etc.)

Price Format: Decimal, 1/4, 1/8, 1/16, 1/32 etc.

Point Value: cash value of 1 point. Each instrument has its own Point Value. It is used for futures (for shares or other type of instrument the value is always 1)

Currency: instrument currency. If instrument belongs to FOREX market, currency will be the denominator. For example, for Euro/Dollar (EUR/USD) the currency to specify is Dollar (USD).

Category: is an OPTIONAL instrument attribute and is used to filter the instrument list in a personalized way.

Real-Time Properties #

Real-Time: if selected, it enables real-time for the instrument

Connection: represents the connection that instrument must use to receive real-time data. Usually it coincides with the main connection

You can define a connection different from main connection in case you want to receive data from one data-feed and trade on another. I recommend you read this documentation

Customize Symbol: customize symbol if:

- the symbol used by real-time connection to indentify the instrument is different from the symbol used by main connection

- or, for example, if you want to receive mini futures data to trade micro using the same connection

Save DOM Data (Depth of Market): Enables saving of DOM (Depth of Market – Level 2) data to the local database, creating a historical record usable by the Market-Depth-Map indicator, Replay, etc.

Real-time DOM data is sampled and saved to the database at 200-millisecond intervals. This approach is necessary to manage the massive amount of data generated by the DOM; without sampling, full data saving would require excessive disk space and memory.

Two properties to configure:

- Number of Days to Save: Specifies the maximum number of days to store. Keep in mind that DOM data consumes significant disk space, so it is recommended to save a limited number of days.

- Number of Bid/Ask Levels to Save: Specifies how many Bid/Ask levels to save. The higher the number of levels, the more disk space will be used.

IMPORTANT!

Rollover does not affect DOM data: no price adjustment will be applied to historical DOM data after a rollover.

Historical-data & Time-Frames Properties #

Historical data series: if selected, it enables historical data receiving for the instrument

Connection: represents the connection that instrument must use to receive historical data. Usually it coincides with the main connection

You can define a connection different from main connection in case you want to receive data from one data-feed and trade on another. We recommend you read this documentation

Customize Symbol: customize symbol if:

- the symbol used by historical data connection to indentify the instrument is different from the symbol used by main connection

- or, for example, if you want to receive mini futures data to trade micro using the same connection

Bar timestamp: specifies whether bar timestamp represents the begginnig or the end of bar. For example, in a 5-minute bar (from 10:00:00 to 10:04:59), 10:00:00 represents the bar’s start-time (On Open) and 10:05:00 the bar’s end-time (On Close). By selecting this property, bar will be identified in the chart with 10:05:00

Time Frames:

You can choose time frames to use for instrument ONLY when you create the instrument MANUALLY (NOT from dictionary).

You CANNOT change time-frames after instrument creation. To do this you need to delete the instrument and add it again MANUALLY (NOT from dictionary)

You have 2 options:

- Standard time frames (RECOMMENDED): it is the option to choose in 99% of cases. It allows maximum flexibility in data and chart management. This option is always selected if you add instrument from dictionary

- Define a specific Time Frame: to use ONLY in case of Metastock historical data provider, or if you need to import data from a text file (.csv) with resolution different from the standard ones (1 tick, 1 minute, 1 day)

By choosing this option you will have to define time frame resolution and quote type (Trade, Bid, Ask) > usually Trade

Trading Properties #

Trading: (check-box) if selected, it enables trading for the instrument

Order Size

- Minimum Lot: specifies order minimum size. In other words, the smallest size allowed to be traded with this instrument

- Size Increment: specifies order size increment. Order quantity can only be a multiple of the value defined in this property

Simulation

- Simulation Account: specifies the (default) account to be used when trading is LOCALLY SIMULATED by Overcharts, i.e. in SIMULATOR Workspaces, in Trading-System testing, and in general in all situations where trading is ONLY SIMULATED LOCALLY by Overcharts and NO orders are actually sent to your broker/data-feed.

This is NOT the account used to trade in demo mode (where trading is simulated by broker/data-feed). To trade in demo mode through Overcharts you MUST request a demo data-feed from your broker!

- Customize Commissions: enable to define specific trading commissions for the instrument. If not enabled, commissions are those defined in the simulation account.

- Commission Type:

- Percentage (per trade): commission is calculated as a percentage of trade total value.

- Cash (per trade): commission is fixed (in cash) for each trade.

- Fixed (per share/contract): commission is fixed (in cash) for each share/contract.

- Commission: commission amount (in cash if Commission-Type is Fixed/Cash, in percentage if Commission-Type is Percentage).

- Minimum Value: (in cash) represents minimum fee applicable to a single trade (0 = disabled).

- Maximum Value: (in cash) represents maximum fee applicable to a single trade (0 = disabled).

- Commission Type:

IMPORTANT! Commissions MUST also be enabled in the related simulation account to be considered!

- Customize Margins: enable to define specific margins for the instrument. If not enabled, margins are those defined in the simulation account.

- Margin Type: specifies whether the margin is defined in Cash or Percentage.

- Required Margin for a LONG trade: specifies the margin required for each LONG trade. Margin is expressed in Cash or Percentage depending on Margin-Type. If set to 0 (ZERO), the required margin will be equal to trade total value.

- Required Margin for a SHORT trade: specifies the margin required for each SHORT trade. Margin is expressed in Cash or Percentage depending on Margin-Type. If set to 0 (ZERO), the required margin will be equal to trade total value.

IMPORTANT! Margins MUST also be enabled in the relevant simulation account to be considered!