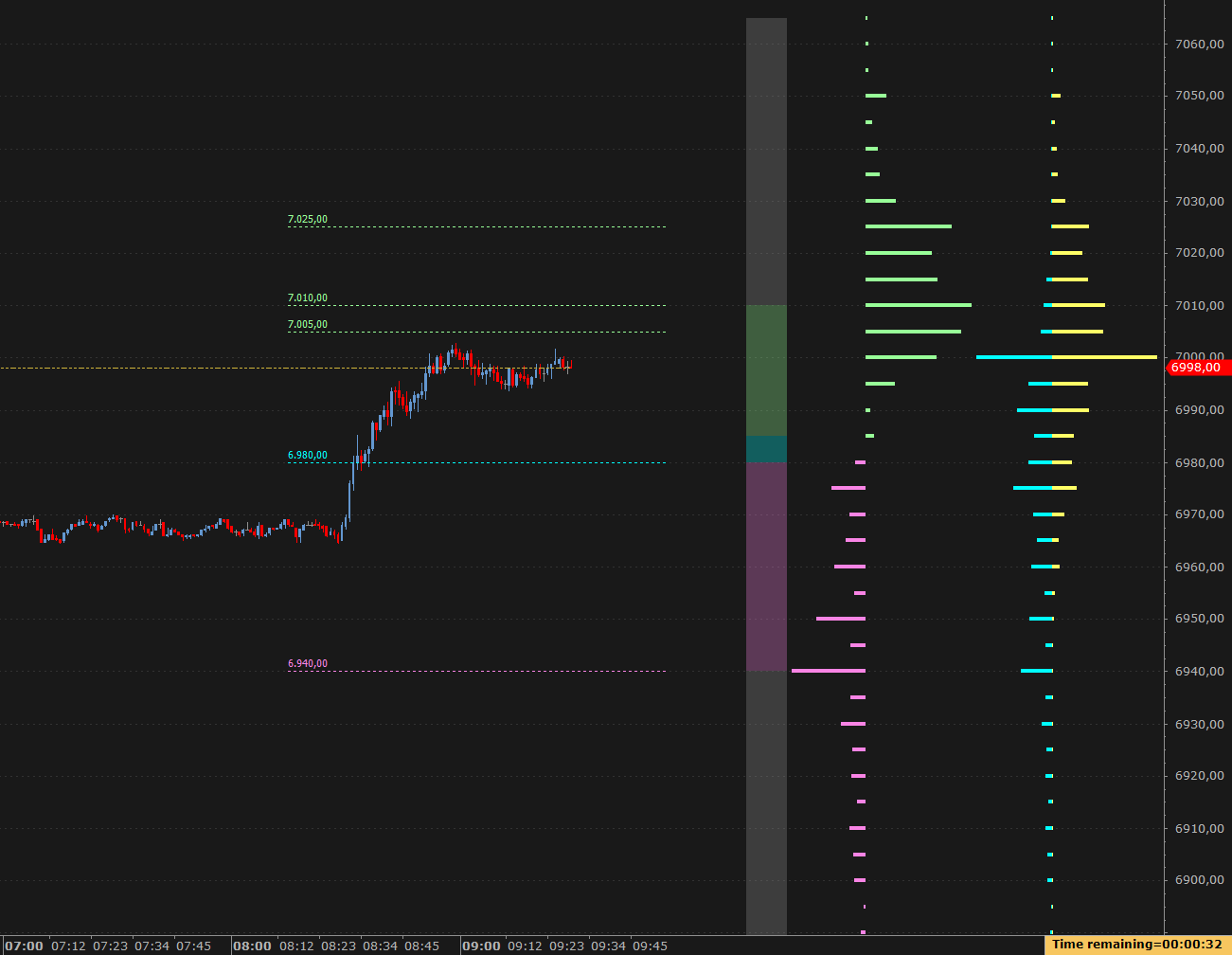

GEX Profile - Gamma Exposure

The GEX Profile (Gamma Exposure) is an indicator designed to identify price levels that act as support and resistance, derived directly from the options market structure.

The GEX Profile (Gamma Exposure) is an indicator designed to identify price levels that act as support and resistance, derived directly from the options market structure.

Unlike traditional technical levels, these levels are not the result of formulas applied to past price data. Instead, they originate from areas where option Gamma concentrates stabilizing or accelerating forces in the market.

Gamma-Driven Support and Resistance

Gamma Exposure describes how market makers react to price movements based on open option positions:

-

Positive Gamma: price tends to be contained and stabilized

-

Negative Gamma: price tends to move faster and accelerate

The GEX Profile translates this information into key price levels, which often behave as:

-

Support / Resistance levels

-

Price containment zones

-

Acceleration areas after a breakout

These levels represent points where the market is statistically more likely to pause, react, or change regime.

Net GEX, Call GEX and Put GEX

The indicator allows separate analysis of:

-

Call GEX: structural pressure from the Call side

-

Put GEX: structural pressure from the Put side

-

Net GEX: overall balance between Calls and Puts

Totals and the Call / Put Ratio further help assess the market’s structural bias.

The GEX Profile is ideal for traders who want to:

-

Identify option-based support and resistance levels

-

Improve entry and exit timing

-

Understand where price is more “constrained”

-

Anticipate breakouts and accelerations

It is particularly effective when combined with:

-

Price Action

-

Volume Profile

-

Order Flow